|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compare Auto Coverage: Your Comprehensive Coverage GuideWhen it comes to protecting your vehicle and managing repair costs, understanding the different types of auto coverage available in the U.S. is crucial. This guide will walk you through the essentials of comparing auto coverage options, focusing on how to achieve peace of mind and potential cost savings. Understanding Basic Auto CoverageAuto coverage can vary significantly, but most policies include several fundamental components designed to protect you and your vehicle. Here's a breakdown of what you should consider:

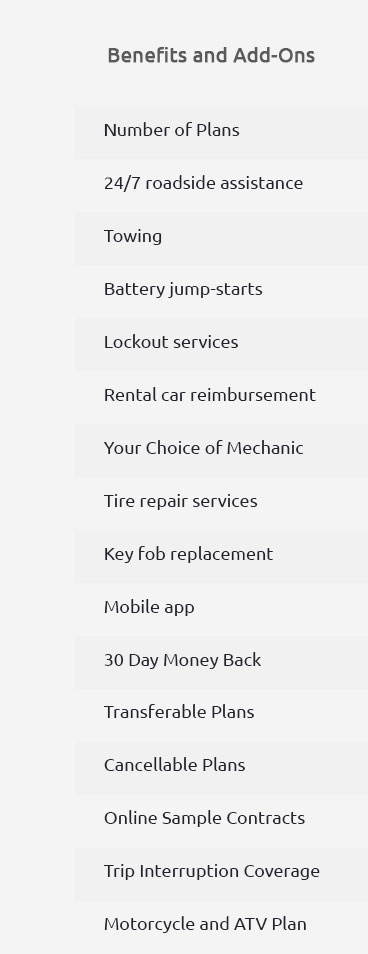

Understanding these basics is the first step to making informed decisions about your auto coverage. Exploring Extended Auto WarrantiesWhile standard coverage handles basic repairs, extended auto warranties offer additional protection, especially for costly parts and labor. This can be particularly beneficial for Chrysler owners looking to chrysler auto warranty rates to budget efficiently. Benefits of Extended WarrantiesPeace of Mind: An extended warranty can relieve the stress of unexpected repairs by covering major components like the engine and transmission. Cost Savings: Although there's an upfront cost, it can save you significant money in the long run, especially if you plan to keep your vehicle for several years. For a straightforward approach to extended warranties, consider exploring easy auto warranty coverage options. What’s Covered and What’s NotKnowing what is and isn’t covered in your auto coverage policy is essential. Here are some key points:

Understanding these exclusions can help you plan better and avoid surprises. FAQ on Auto CoverageWhat is the most important type of auto coverage?Liability coverage is often considered the most crucial type, as it protects you from financial loss if you're responsible for an accident. How can I save money on auto coverage?Compare multiple quotes, consider bundling policies, and maintain a good driving record to potentially lower your premiums. Is extended auto warranty worth it?If you plan to keep your car for many years or worry about expensive repairs, an extended warranty can provide valuable peace of mind and financial protection. https://www.experian.com/insurance/car-insurance-quotes/

Our comparison tool will help you compare auto and home insurance rates from more than 30 top insurers. It is completely free to use. https://www.progressive.com/auto/discounts/compare-car-insurance-rates/

Our car insurance rate comparison tool helps you compare your car insurance quote online with other car insurance rates from other companies. Once you get your ... https://choices.fldfs.com/pandc/auto

Who is covered (demographic features of the drivers); Type of vehicle insured; Type of coverage; Amount of coverage. The CHOICES auto rate comparison tool ...

|